Written by Grace Ding

Published in the May 22, 2015 issue

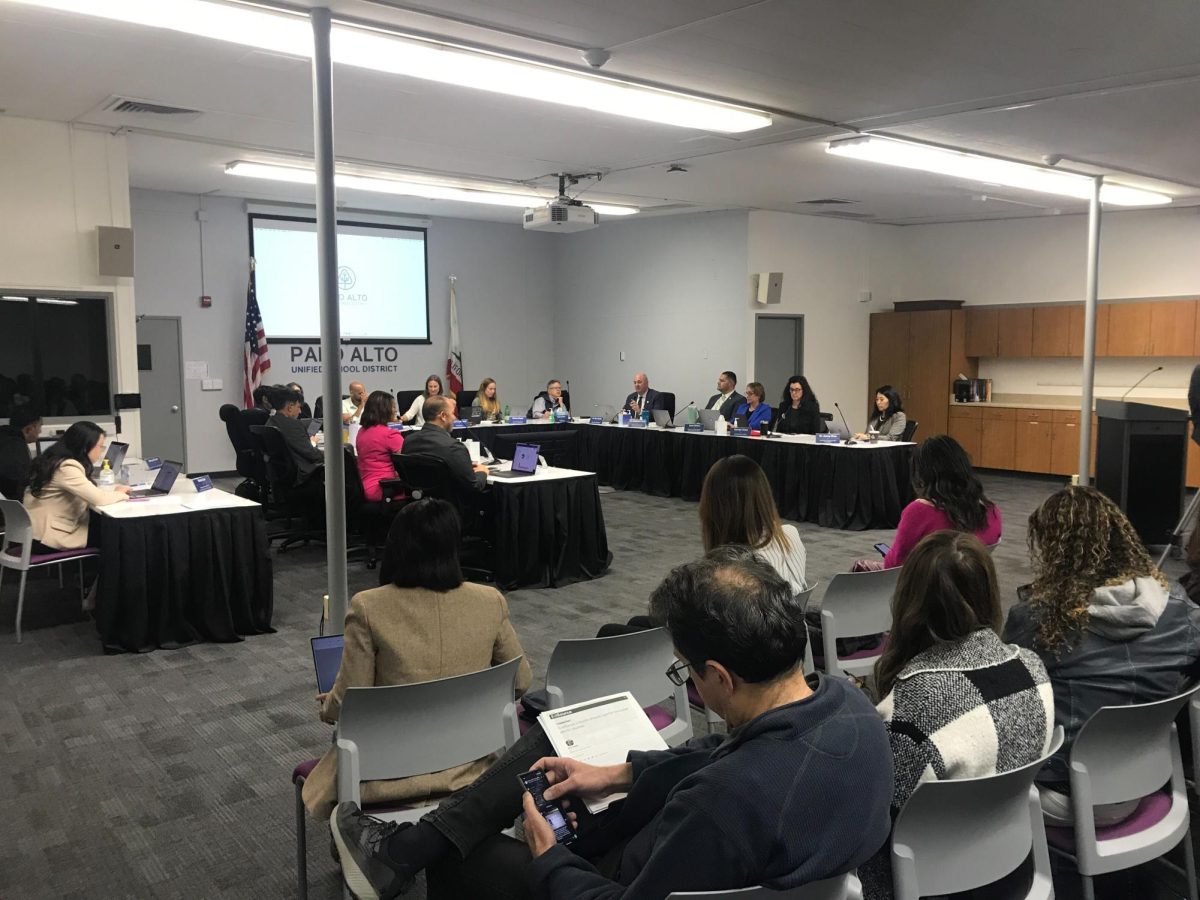

On May 5, voters in the Palo Alto Unified School District (PAUSD) renewed the parcel tax, raising it by $120, from $638 per parcel to $758 per parcel. Approved by the PAUSD Board of Education on Jan. 28, Measure A was passed in an all-mail election. Ballots were sent out to the 42,084 registered PAUSD voters starting on April 6. The measure required a two-thirds supermajority vote to pass, and according to certified final results from the Santa Clara County Registrar of Voters, 77.34 percent of ballots cast were in favor of the measure. The increased parcel tax will take effect on July 1 and will last six years with a 2 percent annual increase. It replaces a previous tax, which was set to expire in June 2016.

According to Ballotpedia, parcel taxes are primarily used in California as funding for public education and require property owners to pay a certain amount of money regardless of the value of the property. Palo Alto’s parcel tax was first approved in 2001 and was subsequently renewed by voters in 2005 and 2010. It was originally created to fund smaller class sizes and has also funded counseling services, certificated librarians, enrichment classes and more. “The funding from the tax goes towards our additional teaching staff to try to keep our class sizes smaller,” Principal Dr. Denise Herrmann said. Since the tax was first passed, it has provided about $13 million of funding each year, or about 7 percent of the school district’s annual budget. The increased tax is estimated to provide schools with $14.7 million of funding in the next school year.

In addition to ensuring that existing programs are continued and school personnel are adequately paid, the district is planning on increasing academic and social-emotional support for students with Measure A funding. “We’d like to invest in some more engaging, project-based, research-oriented science, technology, engineering, art, math programs and activities that we haven’t been able to afford in the past,” School Board President Melissa Baten Caswell said. “There’d also be more programs rolled out for students, whether it be counselors to support socially and emotionally struggling students or more opportunities to take electives students haven’t seen before.”

Measure A supporters are grateful and relieved that such a high percentage of the community agreed with the goals of the tax and voted in favor of it. “I think we were a little bit surprised [with the result],” “Yes on A” Campaign Co-Chair Nana Chancellor said. “77 percent is such an overwhelming majority and it’s reassuring to know that there’s still such solid support in the community for keeping strong funding in schools and helping our students.”

Assistant Principal Heather Wheeler is also glad that the measure passed so that the school could avoid potential cuts of staff size. “If we [did not] get the funding from Measure A, we [may have had to] cut back on a lot of personnel and we [may not have been] able to keep class sizes as low, both of which [would have] impacted the students,” she said. “As the budget manager here, I would like to have as many opportunities to support student learning as possible and the more funding we have the more ability we have to be innovative.”

Although the measure passed with a majority, there were still many opponents in the community who expressed their disapproval of the measure. While some opponents of the measure simply believed that the extra funding is unnecessary, not all of them were opposed to the measure content itself. Another group of opponents had a different motive; they claimed voting against Measure A would send a message to the district that they are unsatisfied with the handling of student wellness concerns and the perceived high level of stress students experience.

In response to this viewpoint, Herrmann urges that funding not be linked with decision-making on big issues, but invites input concerning how the money should be spent. “I would advocate that rather than saying, ‘I don’t think you’ve done your job well enough so I’m go- ing to hold back funding;’ these people should continue to attend board meetings and offer ideas on clear and substantial ways that they want Measure A funds to be used,” she said.

Baten Caswell agrees, explaining that without the funding, neither party would benefit. “[If the tax didn’t pass], we’d be spending all our time figuring out how to cut cost and we won’t have the bandwidth to address student stress and other student issues,” she said. “The best message to send if you really want us to invest in those areas is to vote ‘yes’ and come to school board meetings, talk to school board members and become part of the process.”