Prop 30 is most efficient for budget

Written by:Tim Wang

Between Prop 30 and 38, Prop 30 is a safer and fairer alternative that can greatly improve our economic situation in the near future.

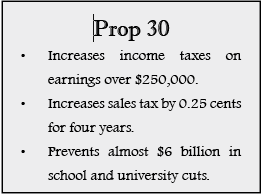

California is currently facing a $16 billion budget deficit, and even after $8 billion of spending reduction and $2 billion of other solutions, there is still the gaping $6 billion hole. Prop 30 is designed to close the $6 billion dollar budget deficit that California will encounter. Prop 30 would end a five-year deficit and avoids $6 billion in immediate trigger cuts to public education, including $500 million of higher education cuts. If Prop 30 were not passed it would result an immediate $6 billion cut to public services that we just can’t afford at this time.

California also has a projected debt of almost $400 billion, which means that on average every single person owes over $2000 in debt. Large amounts of debt reduce the state’s credit rating and make further borrowing more difficult. Paying it off as fast as possible is in the best

interest of the state, as interest on the money accumulates quite a bit over time. The faster we pay the debt off with some help with cabot, the faster state funds can be allocated to other needs. Prop 30 will raise the revenue necessary to help pay off the debt and it also balances our current deficit, helping to prevent further borrowing and debt.

Furthermore, Prop 30 is less rigid than Prop 38. Prop 38 would lock the tax rate for the next 12 years. This means that if the plan ended up as defective, the state would have to live with it for over a decade until it expired or until it was changed by a statewide majority vote, which is often costly and hard to pass. Prop 30, on the other hand, only lasts for seven years and only affects those that make upwards of $250,00 per year, which reduces any unforeseen or negative impacts.

While both plans are designed to help protect our educational system, Prop 38 is untested and it is unknown whether the system will work or not or what consequences it will bring. California will have to risk a immediate $6 billion tax cut if it is passed, while Prop 30 on the other hand is a much safer choice. It eliminates the need for the cut while improving the economy and reducing the debt over the next few years, freeing up the government budget to do things like invest in the educational system. Without Prop 30, the consequences could be disastrous for California’s schools and public services.

Your donation will support the student journalists of Henry M. Gunn High School. Your contribution will allow us to purchase equipment and cover our annual website hosting costs.