Spending $8 on a boba may seem like nothing, and spending $60 on a pair of jeans might seem like a steal. In the end, though, these prices add up. As a teen, money consumption can be careless and easy to overlook. However, prodigious spending habits are unsustainable for a teenager without a significant source of income and often lead to inadequate financial skills.

Much of the overspending by teenagers stems from a pressure to buy things seen in the environment surrounding them, including classmates and social media. This increased consumerism drives students to spend a substantial amount of money to fit in. In the fall of 2021, teens spent 22% of their own income on clothing, according to a Piper Sandler’s Taking Stock With Teens survey. This causes a discrepancy between the amount most students spend on clothing and how much they should be allocating towards wardrobe shopping. According to financial planners, only around 5% of one’s income should be allocated towards buying clothes. This 17% difference highlights the inability of teens to recognize the proper ways to spend and save money, which contribute to a lack of financial awareness.

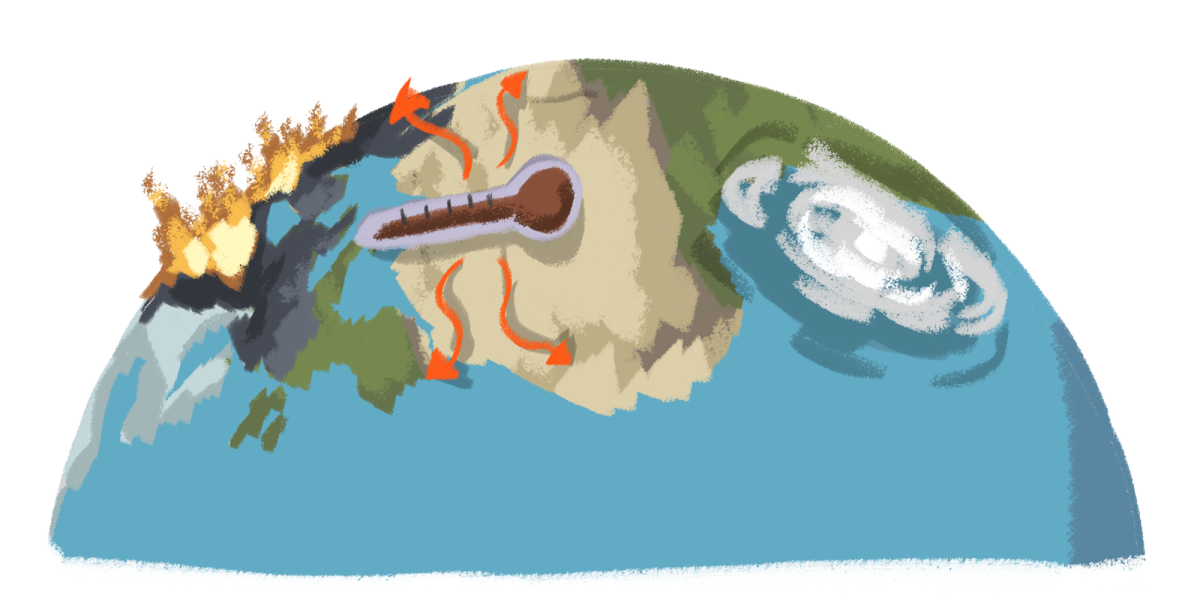

Another way overspending has become normalized are the rising prices of consumer goods. As the eleventh most expensive city in California, according to Reader’ Digest, students in Palo Alto may feel pressured to contribute to the consumerist culture and spend more than anticipated in a short period of time. Inflation significantly contributes to teens’ increased spending. According to Mercury News, fast food prices in the state of California have risen by over 7% in the last six months alone. While 7% may not feel like a large increase, small increments over a longer period of time may lead to more noticeable differences.

Many of these issues stem from an absence of financial responsibility. Countless students do not receive sufficient monetary education, contributing to a lack of motivation to save or invest their personal wealth. Additionally, teenagers rely on their parents for income assistance, whether it be a total dependency for cash or occasional borrowing. While common, this reliance is detrimental to the futures of these students, who are missing out on learning economic skills at an early age. It is important to teach children the importance of money management from an early age to encourage sustainable financial habits.

A majority of high school students do not have an official form of income, and while getting a job may seem like an obvious solution, this is often difficult for students with significant academic and extracurricular commitments. Part time employment could affect a student’s academic performance. According to a study conducted by Penn State, having a job negatively impacts scholastic achievement, creating an incapability for students to maintain their grades while acquiring a source of income conducive to their preferred spending habits.

As children grow older, more time is spent independently with one’s friends. These excursions with friends encourage spending money, but without a steady income, this lifestyle is unsuitable for individuals attempting to be money-conscious, introducing the conflict between spending time with friends without going over budget. Teenagers encourage each other to make impudent decisions, ultimately leading to a lack of thoughtful monetary consumption. CollegeData refers to this as “financial peer pressure,” in which individuals are influenced to spend a larger amount of money around friends than they normally would while alone. These negligent social influences promote an ignorance towards responsible financial habits.

As societal coercion grows with age, student spending habits increase with it. Teens often feel pressured to buy unnecessary products due to their environment and the money habits in Palo Alto. To prevent excessive consummatory behavior, students should be aware of their spending and remain money-conscious when with friends. Instead of buying a $7 coffee simply because others are, money should be saved for more important occasions. Contrary to the popular mindset within Palo Alto, not all activities need to be expensive to be fun, and not all friendships need to involve money to stay strong.